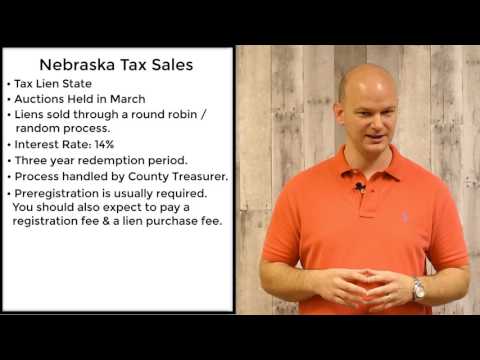

Hey everyone, Casey here! We're talking about tax sales in the state of Nebraska. Nebraska is a tax lien state. In a tax lien state, once the tax becomes delinquent, the county will sell a lien against the property. Investors can then collect the taxes and interest on their money. So, you're buying an interest-earning lien against the property, not the actual property itself. Nebraska holds its tax sales in March of every year. In 2015, the ownership bid-down method used to be used, but thankfully it was eliminated. Now, the liens are sold on a round-robin basis. This means that one bidder receives the option to purchase the lien, and if they decline, the next person in line has the option to purchase it, and so on. It's a pretty simple process when it comes down to it. These liens earn interest at a rate of 14% per year, and the redemption period is 3 years. If the property is not redeemed within three years, the lien holder can then begin the tax foreclosure process, usually with the help of an attorney. The tax lien process is handled by the county treasurer's office. Each treasurer may handle it slightly differently. Most will require you to pre-register and charge a registration fee of around $25. There is also a fee of $20 per lien that you purchase, and these fees are not reimbursable if the lien gets redeemed. The list of available tax liens is required by law to be posted in the county's newspapers. Sometimes, they are also available on the county websites for a fee, or directly from the treasurer's office. Most sales will require you or your agent to be present in person to bid on the liens. The auction primarily addresses liens with a face value of $500 or more. Some counties...

Award-winning PDF software

Nebraska 52 201 Form: What You Should Know

Department of the Air Force on Accommodation of Religious Practices in Buildings Provided for Governmental Functions. This guidance document supersedes Air Force Regulation (AFR) 438-20-01. 555555557. Title 10 — Criminal Law Aircraft Emission Control § 555555557. Title 10 — Criminal Law Aircraft Emission Control 51-15-101. Definition of commercial motor carrier. (1) For the purposes of this subchapter, the term commercial motor VH age means a vehicle that is operated for compensation for the carriage of passengers and that is owned or leased by an entity for compensation, and that: 51-15A-101. Definitions — (a) “Controlled substance” means any drug or other substance, whether compounded, dispensed, administered in liquid or solid form with or without food, or incorporated into any part of a consumer product. (b) “Driver” means an individual who is twenty-one years of age or older who: (i) Has in his or her possession a controlled substance in an amount of one hundred gram or more but less than six hundred grams; (ii) Operates a commercial motor vehicle and is at least eighteen years of age or older; (iii) Signs a commercial driver's license application that is endorsed pursuant to section 61-1-370 (6)(a) and has received a commercial driver's license; (c) “Federal motor vehicle safety standard” has the meaning given in 49 CFR 383.77; “Federal motor vehicles safety standard number” means the International Association of Chiefs of Police standard number assigned under 49 CFR, Part 383; (d) “Immediate family member” has the meaning given in 49 CFR 383.9; (e) “Person” means any person, partnership, firm, corporation, business trust, estate, trust, receiver, or other legal entity, as well as any agent thereof; 51-15-103. Enforcement of laws regulating motor carriers. (a) Except as provided in subsection (b) of this section, the law enforcement authority of a county, city, or town that is a party to a plea bargain with a person and that is required to suspend his or her driver license as a result of the plea bargain may not issue a citation to that person for operating a commercial motor vehicle, except for a violation of this chapter or Chapter 41 of title 52. Title 42, chapter 29, part 11, may be cited as “Title 52.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ga Notice Of Commencement - individual, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ga Notice Of Commencement - individual online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ga Notice Of Commencement - individual by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ga Notice Of Commencement - individual from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Nebraska 52 201